A mortgage offset account is a savings account that is linked to your home loan.

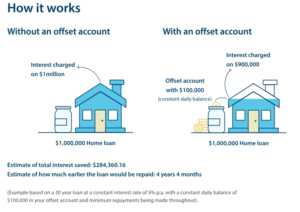

The balance in your savings account is used to reduce the amount of interest charged on your home loan. The higher your savings and the longer they are in an offset account, the less interest that you will pay, which could help to pay off your mortgage faster.

You can also use money in a family member’s account to save interest on your own mortgage by linking the accounts.

An offset account is on a floating rate which is generally higher than a standard fixed rate and not all banks offer them.

The benefits of a mortgage offset account include:

Please contact us if you would like further information.

© 2024 Castle Trust Financial planning. All Rights Reserved. Disclosure information. Privacy Statement.