Covid-19 is obviously a health issue but it has economic and investment consequences too. The disruption caused to the global economic system in an attempt to fight the spread of the pandemic has affected financial markets. It’s natural to be concerned if you see that the balance on your investment statement shows a fall. The important thing to realise that it doesn’t mean a loss. It’s a fall in value. It’s only a loss if you take your money out or switch to a conservative fund. Values rise and fall all the time.

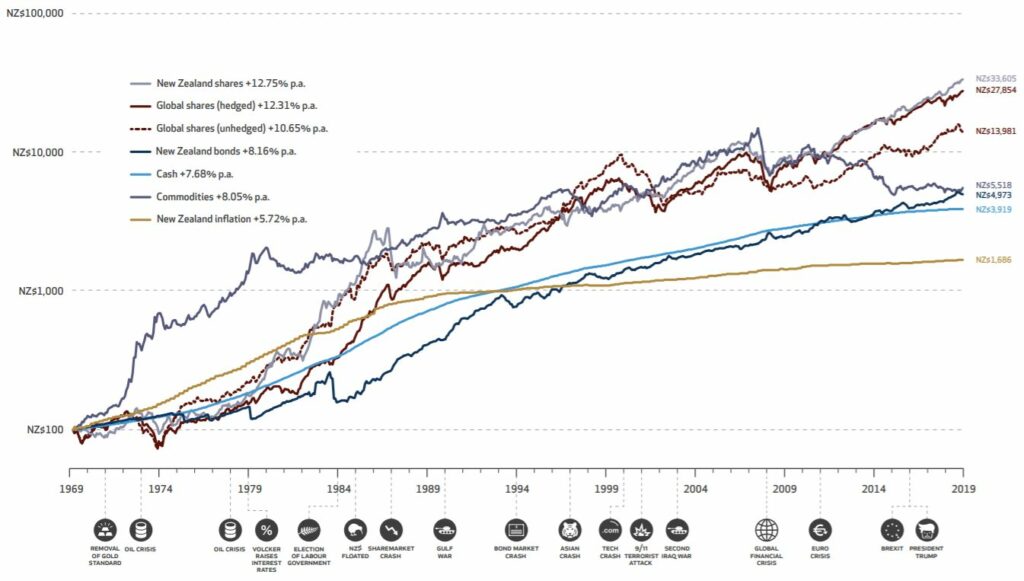

KiwiSaver schemes and managed funds are made up of literally hundreds of different investments around the world (depending on the structure of the fund). Some of the companies that the funds are invested in will be affected badly by the downturn – like airlines. Some of the companies will be affected marginally – like shipping companies. And some will actually do well – like some pharmaceutical companies. But what happens in a ‘crash’ is that all companies have their shares marked down in the short term. Then when the dust settles things get back to normal, investors realise that almost all of the businesses their money is spread across have survived and values recover again. No-one can predict the future but it’s helpful to have a look at what’s happened in the past. Have a look at this long term graph to see how market values have risen and fallen in the past. Up and down. Up and down. Up and down but, over the long term steadily up. Why should things be any different this time?

For all of our investment clients (both lump sum and savings/KiwiSaver clients), we take an active ‘time matching’ approach. The larger fluctuations that we’re seeing at the moment are occurring in what we term ‘long-term’ funds – where you don’t need to access those funds for 10+ years. Yes, it’s disconcerting to see the value go down, but we expect this to happen from time to time. Which is why we take the trouble to time match.

If you’re concerned, of course, get in touch and we can talk about it.

– This article was published in March 2020.

© 2024 Castle Trust Financial planning. All Rights Reserved. Disclosure information. Privacy Statement.