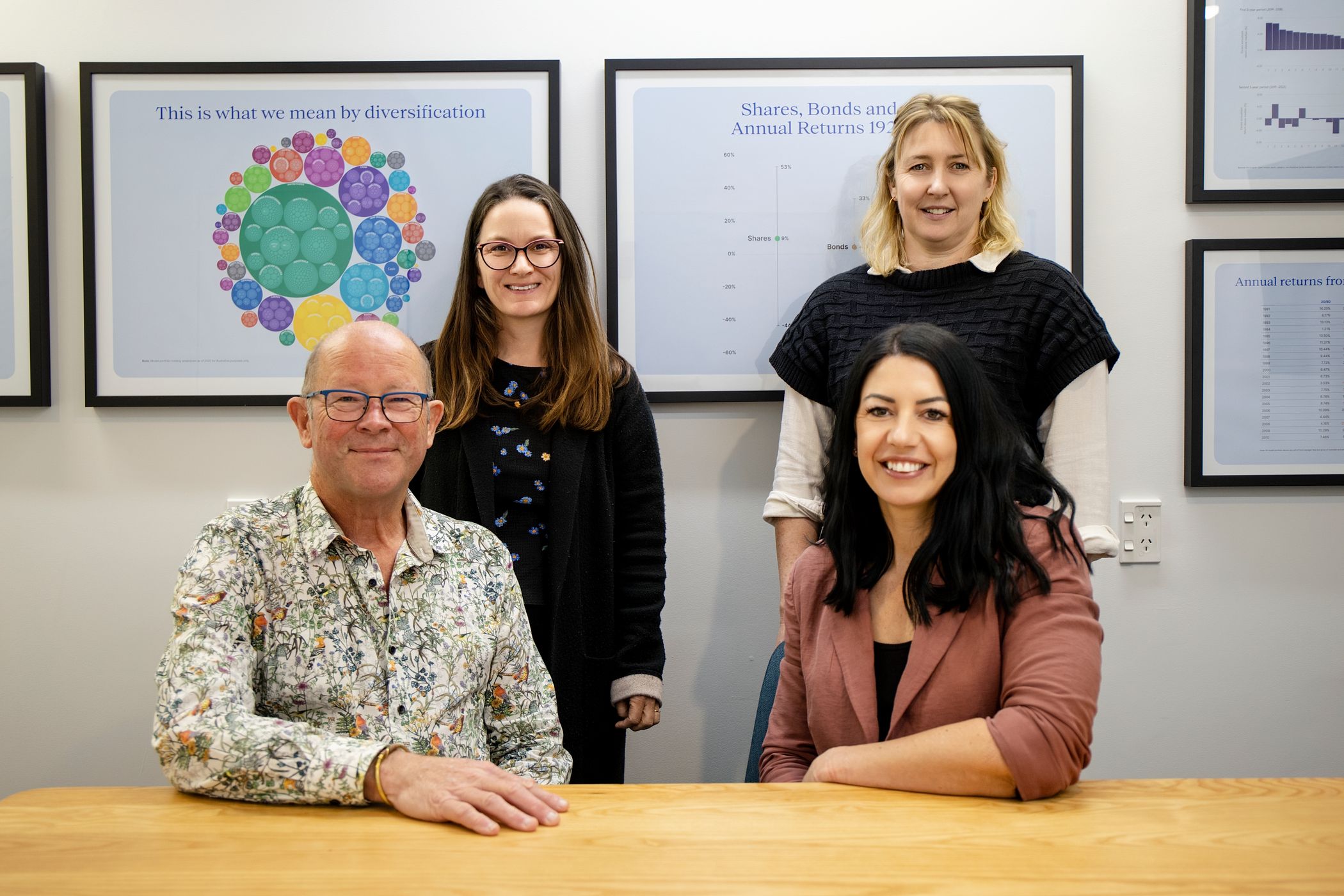

Stuart is a senior Mortgage Adviser with over 25 years in the lending industry. Known for his strategic loan structuring and clear communication, he supports clients from first-home buyers to investors. A member of Financial Advice NZ, Stuart is dedicated to smart, client-focused lending solutions.

Stuart is a highly experienced mortgage adviser with over 25 years in the lending industry. He’s worked with clients ranging from first-home buyers to seasoned investors and is known for his positive approach and expert knowledge.

After running a successful mortgage brokerage, Stuart became a tutor for the NZQA Certificate in Money Management before returning to mortgage advice.

He now helps clients navigate the lending process with clarity and confidence, from initial application through to long-term planning. His focus is on building the right loan structure and achieving the best outcomes, especially in complex or multi-property scenarios.

Stuart’s deep understanding of the lending landscape means he can find smart, personalised solutions to suit a variety of financial goals.

He is a member of Financial Advice New Zealand and remains committed to staying current with industry trends and best practices.

Chevaun is a Mortgage Adviser and Chartered Accountant (CPA), with a Bachelor of Business in Accounting. She combines lending expertise with financial insight to help clients, from first-home buyers to investors, make confident, well-informed decisions that support long-term financial goals.

Chevaun is a qualified Mortgage Adviser and Chartered Accountant (CPA) with a background in property, lending, and accounting. She holds a Bachelor of Business majoring in Accounting and previously worked for a large property investment firm in Brisbane.

Her dual expertise in finance and accounting gives her a broad perspective on how lending decisions impact overall financial strategy.

Chevaun works with a wide range of clients, from first-home buyers to experienced investors, offering clear advice, tailored loan structures, and a strong attention to detail.

She is passionate about helping clients make confident, informed decisions that align with their long-term goals.

Based in Nelson, Chevaun balances her mortgage work with running her own business and raising a busy family with two young children.

Her practical, relatable approach makes her a trusted partner for clients navigating today’s property and lending landscape.

We will collect some basic information and then discuss your options and provide you with information about applying for a mortgage.

Complete our online fact find so we can get more in-depth information about you and carry out a full mortgage assessment.

Complete our online fact find so we can get more in-depth information about you and carry out a full mortgage assessment.

Once we have preapproval, you can start searching for your new home with advice on how to make an offer and what clauses to include.

Meet with our Financial Adviser to discuss mortgage protection insurance - it’s crucial you protect your earnings so you can pay your mortgage.

Appoint other professionals - lawyer, building inspector, accountant (if necessary) and get a quote for house and contents insurance.

When you have found a suitable property and your conditions have been met, we will seek unconditional approval from the bank.

We will confirm with your lawyer that all finance conditions have been met.

We will discuss ways to structure your loan and provide advice around repayments, interest rates and terms.

Your lawyer will review your contract and the banks offer, then contact you to arrange to sign your loan documents.

Once all the above is complete, your property settles, and you obtain ownership. Congratulations!!

If you have used your KiwiSaver for your first home, it is great time to check in with your Financial Adviser again to review your retirement savings.

Every time you need to review your interest rates, we can negotiate rates with the bank and advise you accordingly.

© 2024 Castle Trust Financial planning. All Rights Reserved. Disclosure information. Privacy Statement.