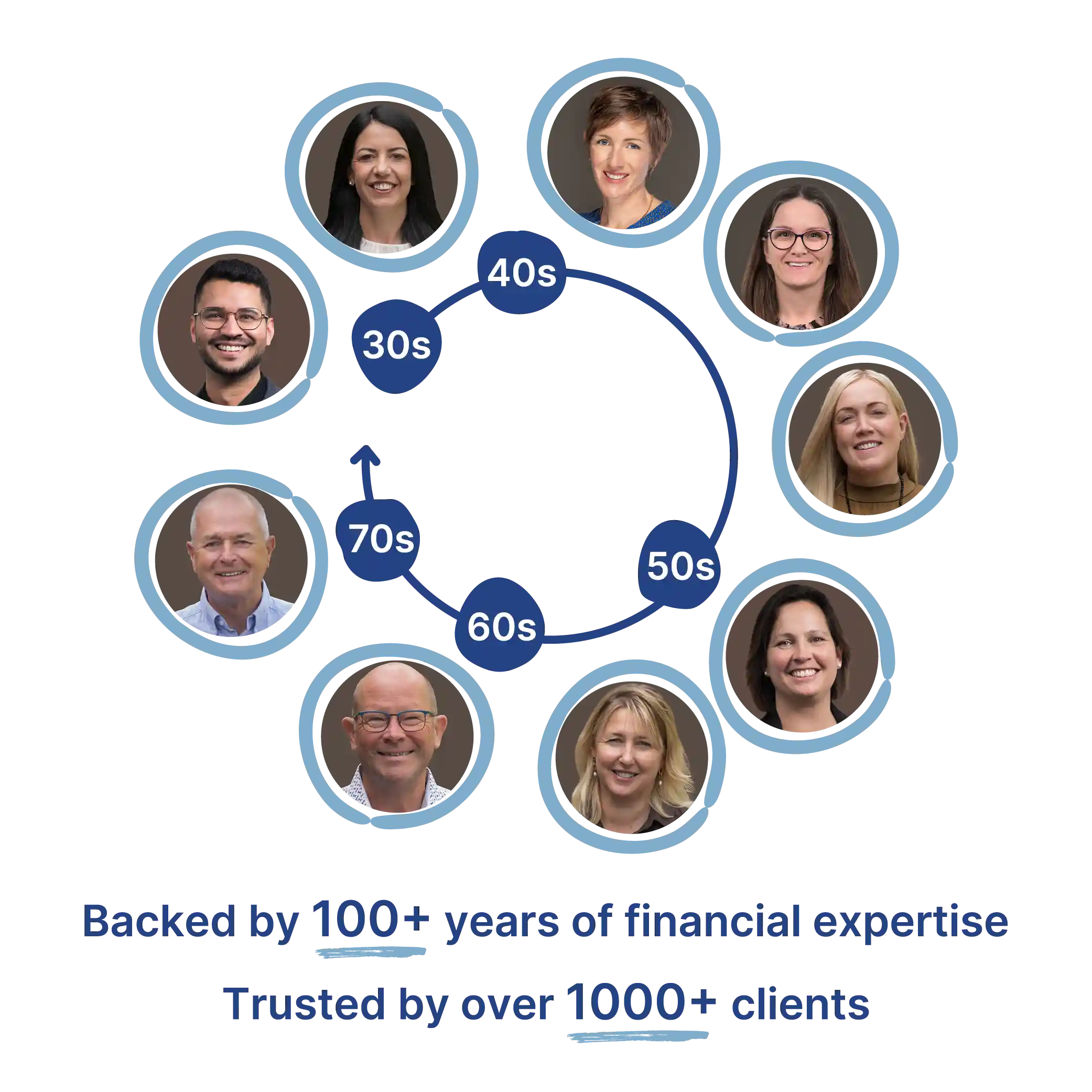

With over 100 years of combined experience, recognition as Trusted Advisers by Financial Advice NZ, and the confidence of over 1,000 clients, we deliver advice that’s built to last.

We know financial decisions aren’t just about numbers; they’re about people, dreams, and peace of mind. Whether you’re planning for retirement, buying your first home, or building up your nest egg, we’re here with sensible, personalised advice that fits your life.

From insurance and savings to mortgages and investments, we help you make smart, informed decisions. As accredited advisers with most major NZ insurers and lenders, we offer access to a wide range of options – without the bias. That means advice tailored to you, not to a product.

Let’s get your finances working for you.

Glyn is a senior Financial Adviser and co-owner of Castle Trust, with over 40 years’ experience in the UK and NZ. A Financial Advice NZ Trusted Adviser and member of Financial Advice NZ, he specialises in retirement planning and strategic advice, drawing on decades of international financial expertise.

Glyn is a business owner at Castle Trust with over 40 years of experience in financial advice. His career began with the National Farmers’ Union in the UK, later founding his own firm and advising clients across the UK and Channel Islands. He brings deep industry knowledge and a strategic, big-picture approach to financial planning.

In the 1990s, Glyn was appointed UK Government Director on the Board of the multi-million-dollar Tuvalu Trust Fund.

Now living in Māpua, Glyn specialises in helping clients approach retirement with confidence, knowing their money will last.

He’s known for treating clients like family and building long-term relationships. If you see him out and about, don’t hesitate to say hello, he’s a true people person. Glyn is a member of Financial Advice New Zealand and holds the Trusted Adviser mark, recognising his commitment to professional, high-quality advice.

Kathryn is a qualified Financial Adviser and co-owner of Castle Trust. She holds a Master’s in Development Studies, a Graduate Diploma in Financial Planning, and oversees compliance and advice quality. A Financial Advice NZ Trusted Adviser, she blends technical expertise with global experience.

Kathryn is a business owner at Castle Trust and has been a financial adviser since 2009.

She brings a strong mix of technical knowledge and global experience to the team, and oversees compliance and advice quality across the business.

She holds a Graduate Diploma in Personal Financial Planning, a BSc, and a Master’s in Development Studies. Before entering financial services, she worked with the United Nations and NGOs in Iraq, Kosovo, Slovakia, and India.

Based in Māpua, Kathryn balances running the business with a busy family life as a mum of three, with children attending Māpua Primary and Waimea College. Kathryn is a member of Financial Advice New Zealand and holds the Trusted Adviser mark, reflecting her dedication to high standards and ongoing professional development.

Anna-May is a qualified Financial Adviser in NZ and the UK with extensive experience across insurance, investments, and property. A Financial Advice Trusted Adviser, she helps clients develop clear, long-term strategies tailored to their life goals, drawing on a well-rounded, international background in financial services.

Anna-May is a qualified financial adviser in both the UK and New Zealand, with decades of experience across insurance, investments, and property.

She began her career in Edinburgh after university, gaining her UK Financial Planning Certificate and working across a wide range of financial services. Her international experience spans roles in client and intermediary advisory throughout the UK, Ireland, and Channel Islands.

Now based in Richmond, Anna-May helps individuals and families develop sensible, long-term strategies tailored to their life goals. Her background ensures well-rounded, clear advice suited to a wide variety of needs.

When not working, she’s often at Garin College events or cheering on her daughter at local sports games.

Anna-May is a member of Financial Advice New Zealand and holds the Trusted Adviser mark, which recognises her commitment to ethical and professional standards in financial advice.

Stuart is a senior Mortgage Adviser with over 25 years in the lending industry. Known for his strategic loan structuring and clear communication, he supports clients from first-home buyers to investors. A member of Financial Advice NZ, Stuart is dedicated to smart, client-focused lending solutions.

Stuart is a highly experienced mortgage adviser with over 25 years in the lending industry. He’s worked with clients ranging from first-home buyers to seasoned investors and is known for his positive approach and expert knowledge.

After running a successful mortgage brokerage, Stuart became a tutor for the NZQA Certificate in Money Management before returning to mortgage advice.

He now helps clients navigate the lending process with clarity and confidence, from initial application through to long-term planning. His focus is on building the right loan structure and achieving the best outcomes, especially in complex or multi-property scenarios.

Stuart’s deep understanding of the lending landscape means he can find smart, personalised solutions to suit a variety of financial goals.

He is a member of Financial Advice New Zealand and remains committed to staying current with industry trends and best practices.

Chevaun is a Mortgage Adviser and Chartered Accountant (CPA), with a Bachelor of Business in Accounting. She combines lending expertise with financial insight to help clients, from first-home buyers to investors, make confident, well-informed decisions that support long-term financial goals.

Chevaun is a qualified Mortgage Adviser and Chartered Accountant (CPA) with a background in property, lending, and accounting. She holds a Bachelor of Business majoring in Accounting and previously worked for a large property investment firm in Brisbane.

Her dual expertise in finance and accounting gives her a broad perspective on how lending decisions impact overall financial strategy.

Chevaun works with a wide range of clients, from first-home buyers to experienced investors, offering clear advice, tailored loan structures, and a strong attention to detail.

She is passionate about helping clients make confident, informed decisions that align with their long-term goals.

Based in Nelson, Chevaun balances her mortgage work with running her own business and raising a busy family with two young children.

Her practical, relatable approach makes her a trusted partner for clients navigating today’s property and lending landscape.

Mel holds her New Zealand Certificates in Financial Services and has over a decade of experience in the financial services industry. With a background in business ownership, she supports the mortgage advisers at Castle Trust and helps clients confidently navigate home lending, from first homes to refinancing.

Mel has been part of the Castle Trust team since 2014 and, holds her New Zealand Level 5 Certificates in Financial Services. She began her journey with Castle Trust in a client support role, gaining hands-on experience while completing her industry qualifications.

Before moving into financial services, Mel owned and operated a successful retail business in Motueka. This experience gives her a practical understanding of the financial challenges individuals and families face, particularly around home lending and budgeting.

Over the past decade, Mel has supported hundreds of Castle Trust clients through key life stages. Now working solely in mortgage lending, she brings deep technical knowledge and a strong client-first approach to every interaction.

Mel helps clients feel confident and informed as they navigate the lending process, whether they’re buying their first home, refinancing, or planning their next move.

Esther supports the financial advisers with investment onboarding, administration, and client service. With over a decade of experience in banking, investment, and financial software, both in the UK and NZ, she ensures processes run smoothly and clients receive attentive, informed support.

Esther works with our investment team, supporting client onboarding, document handling, and day-to-day administration. Esther brings over a decade of experience in finance and client support roles, both in New Zealand and the UK. Her background includes work in investment management, banking, and financial software support.

She spent several years with ANZ and UK-based private banks, helping clients navigate systems, processes, and product information.

Jean-Deric supports our financial planners with admin and client care. With a background in social work, counselling, and mortgage support, he brings strong attention to detail and a calm, capable presence, helping ensure a seamless experience for clients throughout their financial journey.

Jean-Deric’s passion for supporting others began early, with tertiary study in Social Work and Counselling. He later pivoted into financial services, where he continues to make a difference in practical, grounded ways. Prior to joining the Castle Trust Team, Jean spent several years supporting clients through the mortgage process. He brings a wealth of real-world knowledge and a calm, capable presence to the team.

As client support for two of our financial planners, Jean-Deric keeps things running smoothly behind the scenes. His sharp admin skills, attention to detail, and commitment to great service ensure our clients feel supported every step of the way.

Rebecca supports Castle Trust’s mortgage team with loan processing and client service. With over 20 years in finance and HR, and qualifications in HR and employment law, she brings a strong operational background and a detail-oriented approach to client support.

Rebecca has over 20 years of experience in finance and HR, working across multiple sectors in the UK and New Zealand. She holds a Bachelor of Arts, Postgraduate Diploma in HR Management, and a Certificate in Employment Relations and Law in Practice.

Before returning to New Zealand, Rebecca worked in financial services, publishing, engineering, and construction, gaining wide-ranging business and operational experience.

Based in Richmond she now supports the Castle Trust mortgage team with client service, loan processing, and workflow coordination.

We began in Motueka back in 2009, and today we’re based in central Richmond. Our space is designed to be convenient, comfortable, and ideal for financial conversations – whether you’re dropping in for a quick chat or a more in-depth planning session.

While we’re local to the Tasman and Nelson regions, our team advises clients nationwide – from Auckland to Invercargill. And thanks to technology, meeting virtually is always an option too if you prefer.

We’re open Monday to Friday, 9am to 5pm.

© 2024 Castle Trust Financial planning. All Rights Reserved. Disclosure information. Privacy Statement.